Quantify Cyber Risk. Power Smarter Decisions

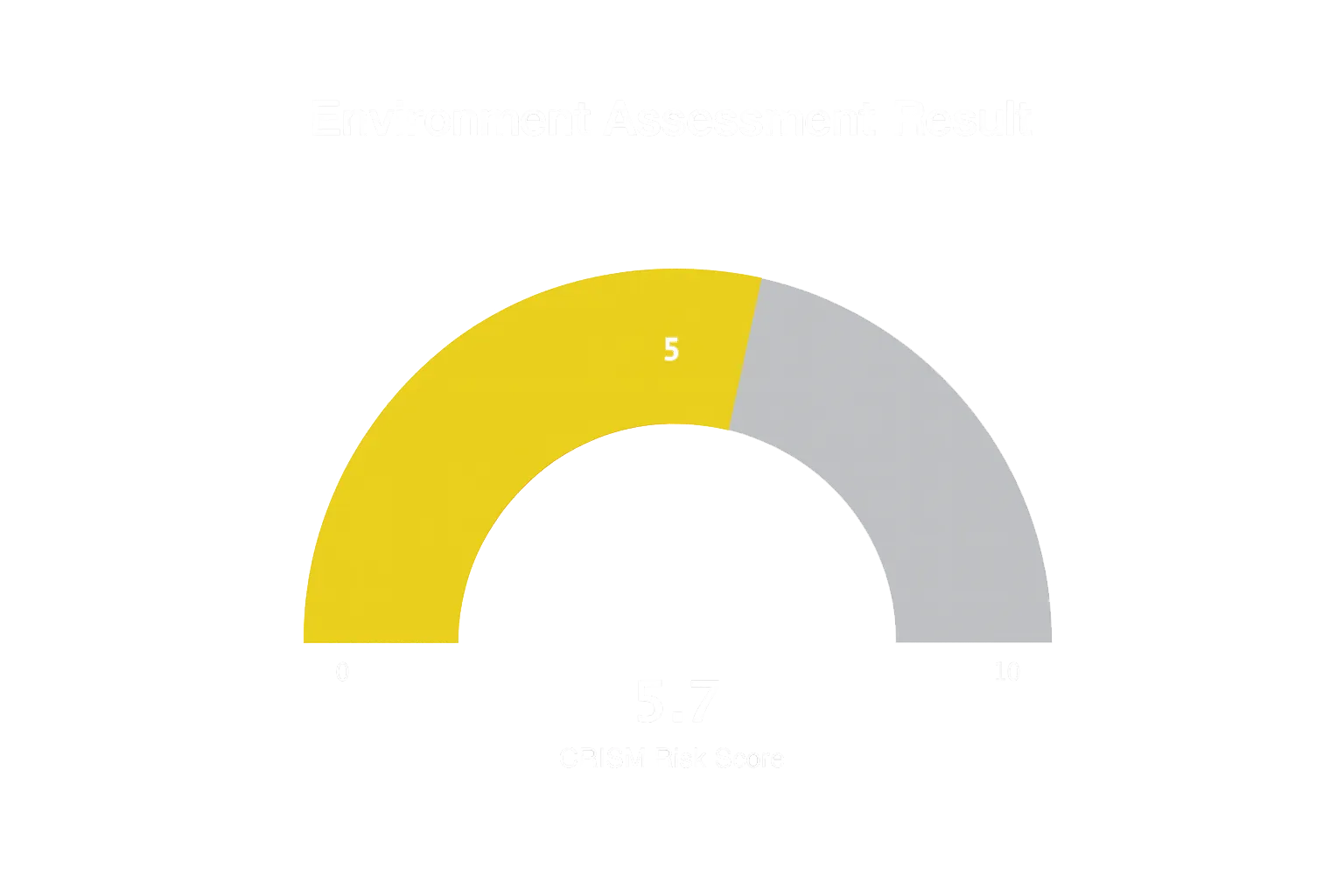

CRISM™ — the Cyber Risk Intelligence Scoring Model — transforms cybersecurity data into a single, trusted metric that insurers, enterprises, and regulators can act on instantly.

Measure. Benchmark. Improve. Insure.

The Cyber Threat Landscape Changes Daily — Your Risk Metrics Should Too.

Cyber risk is no longer static. Attackers evolve faster than insurers and enterprises can measure.

Legacy questionnaires and point-in-time audits can’t keep up. The result: inaccurate underwriting, uninsurable exposure, and compliance gaps.

CRISM delivers real-time, data-driven cyber intelligence that replaces outdated assessments with continuous insight — helping you make faster, smarter, and defensible decisions.

The Universal Metric for Cyber Risk Intelligence

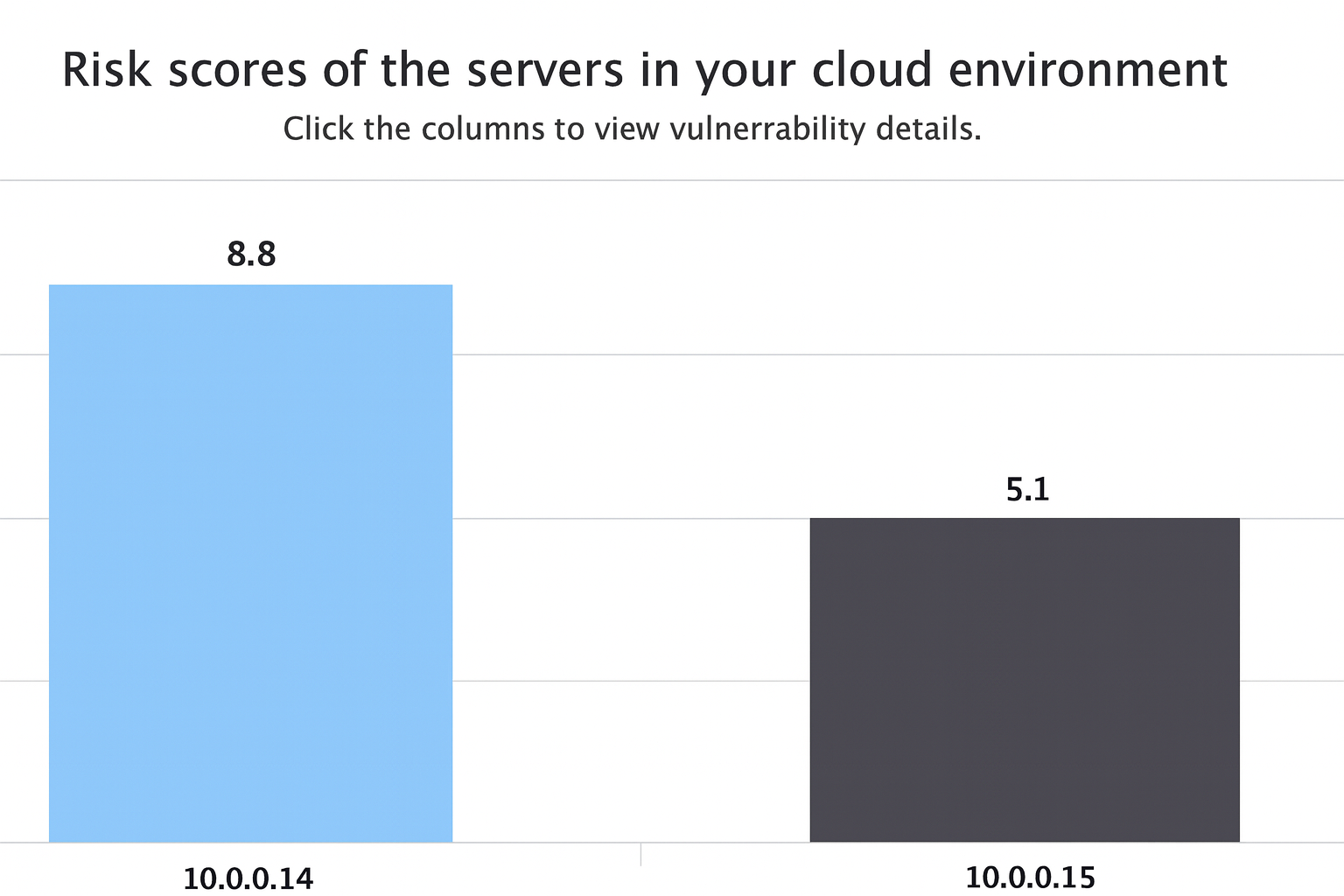

CRISM converts complex cybersecurity data — vulnerabilities, control maturity, endpoint hygiene, and behavioral analytics — into a standardized score that reflects true organizational resilience.

Key Capabilities:

Real-time risk scoring and trend tracking

Continuous posture monitoring and alerting

Predictive loss modeling for underwriting and capital allocation

API integrations with SOC, GRC, and insurance platforms

Configurable dashboards for CISOs, CROs, and underwriters

Why CRISM Matters

| Stakeholder | Value Proposition |

|---|---|

| Carriers & Reinsurers | Replace outdated questionnaires with live risk data. Underwrite faster, with actuarial precision. |

| Enterprises & CISOs | Quantify security maturity and prove ROI on cyber investments. |

| Regulators & Auditors | Gain measurable evidence of cybersecurity control performance. |

| Boards & Executives | Communicate risk in financial terms, not technical jargon. |

Continuous Intelligence. Quantified Risk. Clear Decisions.

Assess

Score

Correlate

Benchmark against industry peers and compliance frameworks (NIST, ISO, HIPAA, FFIEC).

Act

What Sets CRISM Apart

Continuous Cyber Risk Intelligence

Compliance & Framework Mapping

Aligns directly with NIST CSF 2.0, ISO 27001, HIPAA, PCI DSS, and other global frameworks.

Predictive Analytics for Real World Impact

One Platform. Every Industry. Infinite Insight.

CRISM adapts to the unique risk profiles of any organization. From underwriting to compliance, its data-driven intelligence empowers confident decisions across every vertical.

Cyber Insurance & Reinsurance

Healthcare

Financial Services

Critical Infrastructure & Energy

Manufacturing & Supply Chain

Government & Defense

Education

Trusted by Carriers, Reinsurers, and Enterprise Security Leaders

Backed by industry partnerships and actuarial validation, CRISM has demonstrated measurable improvements in underwriting accuracy, compliance performance, and portfolio profitability.

20% reduction in cyber policy loss ratio variance

30% faster underwriting turnaround

Continuous insight across 50+ control domains

Turn Your Cyber Risk Into Strategic Intelligence

Ready to see your risk in a new light?

Experience the future of measurable, actionable cyber intelligence with CRISM.